How Much Does Loan Lending App Development Cost?

Neeraj Rajput

Apr 12, 2025

Digitalization transformed various business sectors while simultaneously reshaping how individuals live their lives. The finance industry represents sectors that changed with digitalization. People now manage their finances effortlessly through home-based operations with the assistance of digital technology.

In finance, loan lending is an essential element that presents no difficulties in contemporary times. Users can easily obtain loans through loan-lending apps following basic step-by-step processes.

Research shows the lending market will achieve US $33.24 billion in 2025. If you want to build an application for loan lending services? A common yet necessary question raises: “How much does loan lending app development cost?” App development costs are vital to every project; thus, recognizing cost is an essential factor.

The process has simplified significantly for estimating loan lending app development costs. Want to know more? Here's all you need. Let's get started.

Why Invest in Loan App Development?

The modern digital era eliminated financial services exclusively from conventional banking establishments and physical brick-and-mortar institutions. Digital platforms known as loan apps emerged as one of the main transformations in the financial sector that enabled users to seek loans through mobile devices. Loan app development provides multiple investment possibilities to businesses operating in fintech, financial institutions, and entrepreneurial ventures.

1. Growing Demand for Instant Lending Solutions

Users demand their financial institutions provide rapid services conveniently alongside electronic transactions. Users can acquire loans rapidly through mobile applications because they require minimal paperwork and immediate fund transfers. Users rely more heavily on mobile loan applications for personal and business requirements and emergencies. The increasing demand results in both broad user adoption and high adoption rates.

2. Wider Reach and Financial Inclusion

The systems of loan applications eliminate geographical barriers in addition to eliminating bureaucratic limitations. Mobile penetration enables loan apps to provide financial services to populations without an established credit history, mainly in developing markets. Implementing financial inclusion through this approach leads to market expansion and dual benefits for social impact.

3. Automation and Operational Efficiency

Loan application development enables automated financial operations that handle checks for creditworthiness, KYC verifications, and loan and repayment tracking. Implementing automated procedures decreases human involvement, thus creating cost savings and strengthening approval speeds while decreasing mistakes.

4. Revenue Generation

Loan applications generate revenue from four channels: loan interests, processing fees, late payment charges, in-app advertising, and premium service packages. They possess a digital platform nature, and this enables increased scalability. Your app development creates a system which handles vast audiences without needing additional expenses for development maintenance.

5. Brand Value and Customer Loyalty

A fast yet user-friendly secured lending experience helps users build trust while growing their loyalty. IT services such as credit score monitoring, adjustable EMI payment structures, and immediate assistance facilities will improve consumer experiences, drive new customers, and enhance market reputation.

6. Future -Ready Investment

The increasing demand for fintech app development includes loan apps as one of their primary sections in this market expansion. A current investment in a loan application platform puts your enterprise in a strong position to expand during upcoming periods. Your application should integrate blockchain technologies, AI algorithms, and open banking protocols because these emerging features ensure your application remains advanced.

How Much Does Loan Lending App Development Cost?

The cost of developing a loan lending application for 2025 spans a broad scope depending on your development requirements. Let's break it down:

Basic Loan App Development Cost

Basic applications with features allowing users to register and request loans while enabling tracking of their payments will cost between $15,000 and $40,000. At the minimum standard, a loan lending app provides users with basic functionality to start with market entry.

Mid-Level App Loan App Cost

This price range requires a middle-market loan lending application, real-time alerts, credit score access, and operation across iOS and Android devices. The price bracket of $40,000 to $80,000 creates an optimal area for organizations that want to provide better user-oriented experiences.

Advanced App Development Cost

An app development cost range exists for feature-rich services integrating AI assessment technology with personalized dashboards equipped with analytical tools and elevated security systems. Such applications are optimized for the needs of broad user bases.

Factors Affecting Loan Lending App Development Costs

Multiple important factors determine the total expense involved in developing loan lending applications. These core features enable effective budget planning so you can make better development decisions.

App Features and Functionality

The features of an app define its functionality for long-term operability. Developing an economical loan lending app only requires basic functionality such as loan applications. Developing sophisticated apps containing extensive advanced technology features surpasses the cost of basic applications.

Design User-Friendly Interface

A user-friendly interface is essential for drawing user attention while motivating constant interaction. Developing an attractive loan lending app demands accurate icon placement, brand-specific colour schemes, simple typography, and diverse animations. Developing all these components leads to elevated development expenses because they require substantial financial resources.

Back-end & Front-end Development

Strategic back-end development is vital to secure transactions performed in apps that offer loans to users. Back-end developers combine API networks with server systems and database structures to process secure transactions and handle real-time information, which drives up development expenses.

Incorporating Security Features

The security system of a loan lending application must incorporate advanced protections that guarantee financial transaction security and user trust. Security features consisting of biometric logins and fraud-detection systems, together with two-factor authentication, drive up the total development expense for the application.

Industrial and Regulatory Compliance

Industrial and regulatory compliance is one of the main elements impacting the expenses incurred during loan lending app development. The application requires ongoing operation by following rules for anti-money laundering details, customer protection, and data privacy regulations, including GDPR (General Data Protection Regulation). Meeting these regulations requires yearly reviews and continuous updates that boost the application's development expenses.

Third-Party Service Integrations

The loan lending app improves functionality by connecting to multiple payment gateways and communication tools. The expense rises because these systems require their operators to pay fees for smooth operation.

Experience of the Development Team

Establishing a successful loan app development company is essential to create a dependable and flexible loan lending application. Their experienced team implements agile development processes with designers, dedicated developers for hire, and software QA testers to establish the loan lending app at its highest level. Even though the company charges elevated prices, the delivered outputs are substantial.

Tech Stack Used in the Development

A tech stack serves as the foundation for specifying application features and other aspects related to security and sustainability, along with performance and compatibility. Using high-quality tools and technologies becomes vital in building a loan lending application. According to the schematic below, the application development utilized these fundamental technology components. The technical breakdown will clarify how much it costs to build a loan app.

Choice of the Deployment Platform

Selecting a deployment platform is the second element determining loan lending app development expenses. Different codebases needed for multiple platform development increase the development time and expenses. Each different deployment platform imposes particular requirements that extend the team's development costs.

Testing and Quality Analysis

A loan lending app requires complete testing and verification to work properly and securely. Both quality assurance testers who conduct manual identifications and automated tools for bug tracking will increase development costs for the loan application.

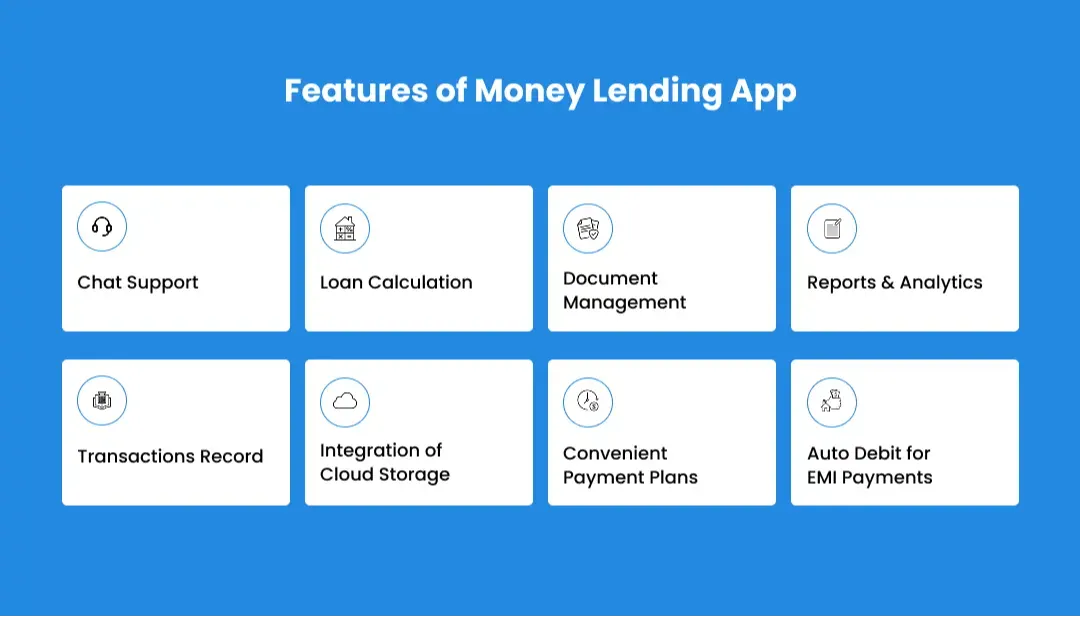

Must Have Features of Money Lending App

Your loan application needs essential and advanced features to excel in the loan lending market. Every loan application differs and has unique characteristics. Still, essential elements provide consistent usability for all money-lending apps regardless of their specific type or the targeted issues. These include:

· Chat Support

Users will likely need support from AI chatbots despite the excellent capability of lending apps to remove face-to-face contact with staff. Using live agent chat is an excellent solution when handling such situations.

· Loan Calculation

The lending platform must support users in computing loans. The process of loan calculation should not burden your application users. Users need an integrated calculator for loan data calculation through the application. Your loan app should help users understand essential loan information like interest rates, monthly payment amounts, and other necessary details.

· Document Management

Your app should offer an easy way for users to handle documents since they need document deletion and uploading capabilities. Loan applicants need a document management system within the app to submit their required documents like identification proofs, income statements, and address verification while maintaining total security.

· Reports & Analytics

Administrators should access a dashboard with full reports and deep analytics to boost loan management productivity. This feature allows administrators to access key metrics that reveal disbursement amounts and repayment collections during defined time frames, thus improving loan management.

· Transactions Record

The application must include a well-organized system for users to view their financial records. This feature lets users see completed and pending payments from a single interface. The integration allows borrowers to see their current loan debt amount and payment dates alongside all previous transacting activities, which helps enhance financial planning capabilities.

· Integration of Cloud Storage

The application strengthens its capacity to store and handle extensive amounts of sensitive user data through cloud storage. Users benefit from cloud integration by achieving encrypted storage and easy accessibility, together with trusted backup systems that provide extensive security protection for their personal data and financial information.

· Convenient Payment Plans

The payment plans for users should offer flexibility and transparent terms matching their authorized loan amounts. The system allows customers to handle their loan repayments efficiently by paying only their obligation amount.

· Auto Debit for EMI Payments

Through the implementation of an automatic payment system, lenders enable the successful deduction of loan repayment amounts from account funds. Through this security feature, lenders guarantee fast payments and eliminate payment delays, which deliver simple administrative processes to both parties.

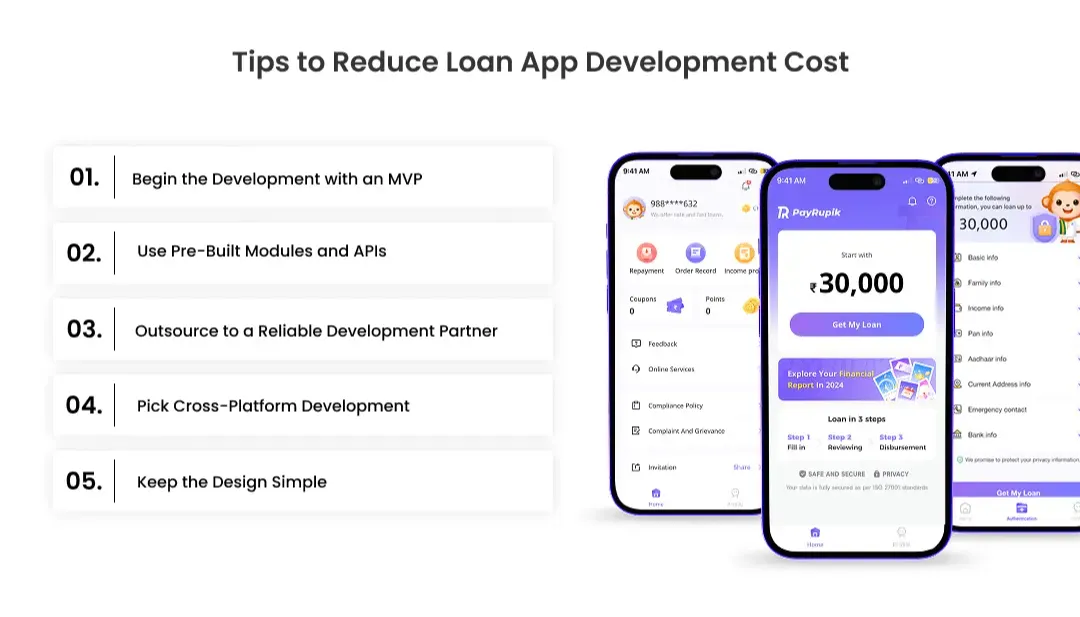

Tips to Reduce Loan App Development Cost

Building loan applications represents a valuable financial commitment, although improper management will result in high development expenses. You can minimize your development expenses through multiple efficient strategies that protect the quality standards.

The following checklist includes the essentials to build a money-saving, high-performance loan application.

1. Begin the Development with an MVP (Minimum Viable Product)

The first goal should be to create a Minimum Viable Product (MVP) instead of developing a full-scale application. The required features for loan processing funds must consist of user registration followed by loan application validation, which ends with repayment procedures. Implementing an MVP allows businesses to launch quickly while collecting user feedback to reduce costs on unneeded features.

2. Use Pre-Built Modules and APIs

Third-party service suppliers provide application programming interfaces and software development kits that enable KYC verification, payment gateway access, credit score evaluation, and customer support dialogue functions. Implementing pre-built solutions through integration proves less expensive than self-development of similar functionalities.

3. Outsource to a Reliable Development Partner

Developing and maintaining an in-house team for software development will cost the company significantly. Organize software development through a licensed industry-leading company or independent fintech professionals for hire. The combination of offshore talent lowers project costs without affecting the end quality standard.

4. Pick Cross-Platform Development

To avoid duplicating the development process, developers should select cross-platform frameworks like Flutter and React Native. Using unified codebases across different platforms lowers your expenses and sharpens development speed.

5. Keep the Design Simple

Users should interact with a clean interface design that maintains simplicity instead of over-flashiness. The design should concentrate on simple navigation paths alongside critical features. Design and front-end development expenses decrease when organizations simplify their custom animations and design elements.

Conclusion

The development expenses for loan applications depend heavily on app intricacy, features, action, geography, and physical location of development teams. The development of basic loan applications, which contain necessary features from user registration to loan application through document upload and payment integration, needs an average cost between $20,000 and $40,000.

The price range for an advanced loan application, including AI-based credit scoring features, extends between $50,000 to $100,000 and above. A well-developed loan app is an important strategic asset providing long-term value. The technology-based mobile solution connects your brand with larger customers, making your financial service establishment appear advanced and technologically up-to-date. Combining strategic planning with an appropriate mobile app development partner brings features and return on investment to your loan application.